Talking better product launch and allocation decisions with Ferrero USA

The global confectioner mitigates waste, improves service levels and controls costs by connecting digital supply chain visibility with POS analytics.

Keep readingAt the recent Gartner Supply Chain Executive Conference, one of the standout sessions was “The Penalty Conundrum — Suppliers and Retailers Can Both Benefit From Renewed Focus on OTIF.” It featured Monique Picou, Senior VP of Flow and Supply Chain at Walmart, who shared the motivation behind the retailer’s recent increase in On Time In Full targets for suppliers.

In her presentation, Ms. Picou repeatedly emphasized that Walmart’s penalties for late or partial deliveries are in no way a money grab. Instead, the changes are an effort to actively engage suppliers in the process of meeting modern consumer demands.

“When you're very, very busy, you're not looking to wait. The days of waiting four or five hours to get [what you want] are over. That’s just not the way we live anymore.”

In response, Walmart is on a journey to become a “precise retailer.” It is focused on servicing consumers and meeting their rising expectations.

“If we don’t get your product when we should, and we have to substitute something else, [our customers] are not happy,” Picou said. “And if they leave our stores or leave our online shop and go somewhere else, it’s a loss for us.”

The fact is, it’s a loss for both Walmart and its vendors. If a shopper chooses a different brand or not to purchase at all because a product isn’t available, it’s a lost sales opportunity. And according to Walmart’s analysis, 30% of store outs are driven by in -full performance, impacting in-stock rates by 90 basis points.

So much as we hate to admit it, the why behind Walmart’s expectations makes a lot of sense – everyone in the supply chain should be focused on serving the end consumer.

Picou acknowledged the role that Walmart itself plays in helping suppliers meet the high targets they have laid out.

“As we’re making these demands, we realized we probably were not enabling you to win with us. It’s going to take all of us winning together to ensure when that shopper walks our stores, or our online presence, that he or she is getting what they want. So we’re doing a lot of investment in business analytics, I have a whole team of data scientists who are helping us figure out what is flowing through the product base, how should we make adjustments, how do we leverage our order quantities… And that investment you’ll see is in our base business so we can enable you with some of the tools that allow you to not have the penalty.”

Specifically, Walmart is investing in three key areas:

In return, they have three supplier asks: leverage newly shared data, support Walmart innovation, and improve in-full performance.

While these may sound daunting, Walmart’s own journey can offer some perspective. Picou said they were using “lots and lots and lots of Excel spreadsheets, moving them from terminal to terminal and desk to desk, which was not efficient or effective.” From that starting point, it’s been a significant journey to a digital supply chain.

In addition, Walmart is working closely with suppliers to achieve these goals. She mentioned two suppliers in particular, one large and one small, that they have been partnering with and are now already achieving the OTIF targets.

So, now we have the why (“If we don’t meet shoppers demands, we all lose”), but what about the how? How do suppliers need to respond in order to not only avoid penalties, but actually thrive in this new, tighter window of OTIF demands?

Simon Bailey, the Gartner analyst who hosted the session, suggested suppliers should base their response on their supply chain maturity level.

Less mature suppliers should start by simply holding extra stock so they have enough inventory of absolutely every single item when it comes time to fulfill an order. Somewhat more mature organizations are advised to examine their inventory management processes and take into account regular delays that keep them from making on time shipments.

Even more mature suppliers are advised to invest in master data management to enable better communication and collaboration with customers. They can proactively partner together with retailers to resolve issues and prevent lost sales.

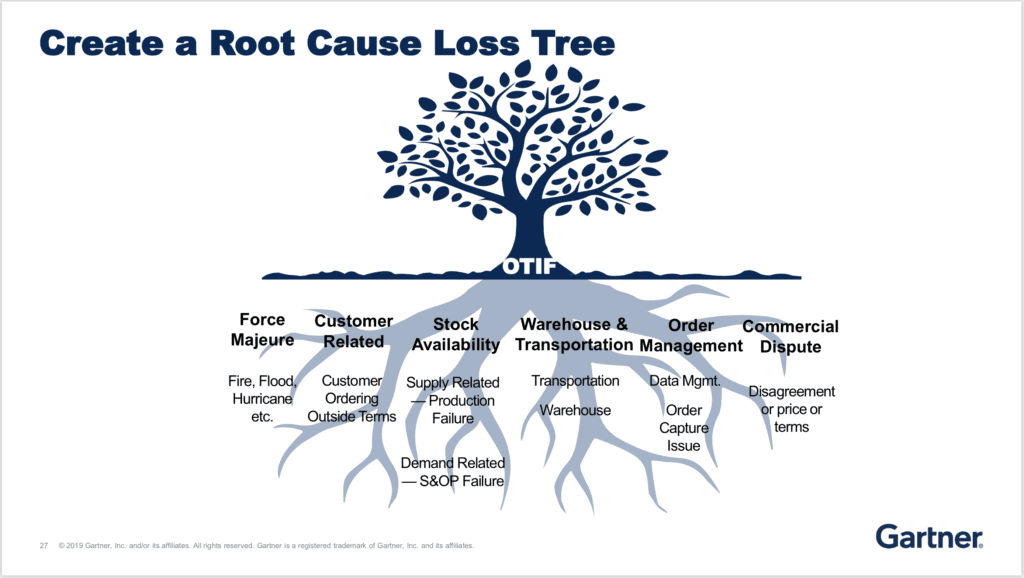

A vital tool in the supplier arsenal for avoiding penalties and improving performance is the “root cause loss tree.” The concept is that every failure should be thoroughly examined, and you should keep asking “why” until you can pinpoint its root cause.

Thus, teams should be asking themselves: Why did this delivery fall short? Why were we late? Why weren’t we in full?

Even something like “acts of nature” deserve a deeper dive. If it’s a hurricane that caused a delay, you should ask, “Are hurricanes a regular occurrence in our part of the country?” If so, adapting travel routes to achieve OTIF delivery despite risky conditions could be the answer.

Finally, Bailey emphasized the importance of aligning your metrics to your retailers and looking at them from a customer point of view. For example, teams should not be looking at an internal fill rate, which often takes into account exceptions where the missed target is the retailer’s “fault,” but focus on a customer view of fill rate and whether they accepted it or not.

“Understand your retailer and understand yourself. Switch your thinking to consider that you're both serving the same end consumer. Ask ‘how do I align my metrics with [Walmart]? How can we work as partners to actually deliver on the OTIF targets?”

Of course, this approach goes for your relationship with any retailer, not just Walmart. Target, Amazon, and others each have their own metric targets and definitions, which are integral to speaking their language and collaborating effectively with them.

It can be a lot of time and effort to manage, between keeping track of all the nuances between retailers and managing all the data they’re sharing and expecting suppliers to use. But it’s a problem we’re very familiar with here at Alloy and would be happy to discuss with you!

The global confectioner mitigates waste, improves service levels and controls costs by connecting digital supply chain visibility with POS analytics.

Keep readingHow to take an iterative approach to digital supply chain transformation with real-time alerts that motivate teams to collaborate on issue resolution

Keep readingUnderstand how gaps between systems, teams and processes are keeping you constantly firefighting and hurting your supply chain resilience

Keep reading