Supply chain management is just the start

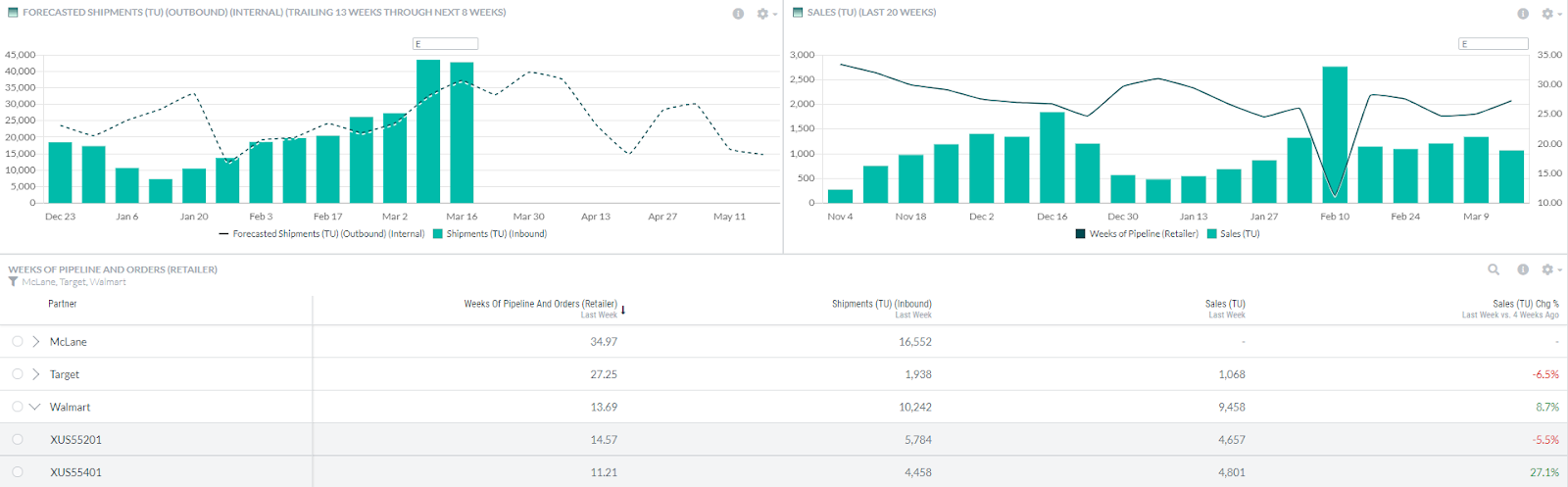

Although Glenn’s focus is supply chain, his experience with Alloy shows that real-time, harmonized data that brings together supply and demand promises benefits throughout the organization. His priorities are reducing waste, reducing lost sales and improving on-shelf availability, but he recognizes that there may be an entire set of sales applications that are just not natural to his language.

It has tremendous value for supply chain, but supply chain value…tends to be more around prevent, and prevent is not a good business problem. You want to add or increment, which is truly a sales problem.

In fact, when Ferrero first started working with Alloy, the users were about 75% supply chain and 25% sales. Now a year later, it’s probably 50-50, and they’re looking at how it could be relevant to trade marketing as well. For Glenn, the beauty of it is that “the tool doesn’t have to be everything to everybody. It can be X for one set of people, Y for another set of people, but it’s all running the same data in the background.”

In fact, Glenn’s finance partner reviewed their business case and said the cross-functional visibility alone pays off the investment. New use cases will continue to provide more ROI on top of that.

Learn more about Ferrero USA’s journey – including how to get started and drive adoption – by watching the entire webinar here.

When it comes to food, spoilage is always a concern. On top of that, Ferrero produces many seasonal products – a Christmas tree-shaped box, for example, where demand drops the day after the holiday. It’s a challenge folks across many industries can relate to.

When it comes to food, spoilage is always a concern. On top of that, Ferrero produces many seasonal products – a Christmas tree-shaped box, for example, where demand drops the day after the holiday. It’s a challenge folks across many industries can relate to.