Talking better product launch and allocation decisions with Ferrero USA

The global confectioner mitigates waste, improves service levels and controls costs by connecting digital supply chain visibility with POS analytics.

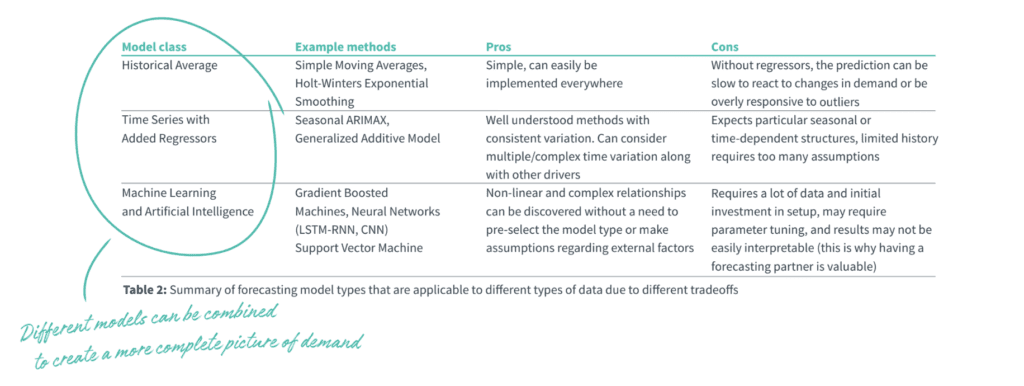

Keep readingOnce you have the right data and it’s been cleaned to account for out-of-stocks, there’s no shortage of algorithms to choose from to build demand forecasts. From longstanding best practices to cutting-edge methodologies, they vary in terms of complexity, assumptions, what types of data inputs they require and how they weight them.

So what’s the right model for you? The short answer is, the one with the highest forecast accuracy and least bias. But that’s not helpful unless you have a way to test and compare each algorithm, especially given the answer will be different for each of your product categories, and potentially even SKUs.

Say you sell a machine as well as parts and supplies for that machine. Think razor and razor blades, or coffee maker and coffee pods. What demand looks like for each of these categories is probably pretty different, necessitating different algorithms. Say you further sell coffee pods with seasonal flavors in addition to your base flavors. Demand for these SKUs probably looks different too, again making different algorithms the best for each one.

The right one could also change over time. Naturally, as a product goes through its lifecycle demand patterns will shift. But it could also be the result of changes you make. For example, you might switch from doing frequent promotions to an “everyday low price” marketing strategy. This shift will likely make a different algorithm the best one for your products.

Even with today’s computing power, we don’t recommend blindly throwing every algorithm at the problem to see what emerges as the “winner.” For one, it can become a distraction. Your team gets caught up adding algorithms when they should be focused on adjusting plans based on the latest data. For another, it leads to a lack of transparency and understanding of how a forecast was created. That makes it hard to explain your demand plan, and even harder to build trust in it.

Instead, make educated decisions about which models are right for each of your products based on their characteristics, aided by technology as much as possible. Next we’ll review three different classes of commonly used modeling methods and their associated tradeoffs.

Historical average models smooth out demand by taking averages over different historical periods. This is one of the simplest classes of forecasting models and tends to work well for long-term or high-level demand planning, where basic trends over time are most important to understand and the daily or weekly variation can be de-emphasized.

2. Time series with added regressors

2. Time series with added regressorsThis class features regression models that are fit by comparing different historical time periods. These models can also incorporate other inputs, such as price promotions, seasonality and weather patterns.

Machine learning models are a broad set of methodologies that use more complex mathematical techniques to select variables and optimize fit where there may be complicated interactions between features. These can be powerful choices, but you’ll want to make sure these obey the integrated, transparent and actionable properties described in our white paper.

While the increased complexity of AI/ML models can yield more accurate demand forecasts in some cases, tradeoffs in the difficulty of implementation mean that the nuances of your products determine which model will yield the best results for you. So, how do you go about choosing the right model, or set of models, for your business?

Weighing each model’s pros and cons is a start, but your products might not neatly fit into a single type. To work around this limitation, it’s also possible to build an ensemble model. This approach takes models from multiple different classes and averages across them. It has the benefit of incorporating effects generated from each methodology, strengthening similar effects while canceling out inconsistent effects.

The global confectioner mitigates waste, improves service levels and controls costs by connecting digital supply chain visibility with POS analytics.

Keep readingHow to take an iterative approach to digital supply chain transformation with real-time alerts that motivate teams to collaborate on issue resolution

Keep readingUnderstand how gaps between systems, teams and processes are keeping you constantly firefighting and hurting your supply chain resilience

Keep reading